Introduction

Our team have built up considerable in-depth experience at international level over their careers and have dealt with some of the most complex insurance problems and claims confronted. These problems include not only how to price risk, but also to understand the methodologies and financial risk management required behind this knowledge to ensure stability, continuity, and solvency.

For every client, whether small or large, we adopt the same approach to assessing risk. We have seen the impact of badly arranged insurance policies and strive to help every client avoid similar problems. We have many examples where the team have been called in to resolve problems and find insurance solutions across all the sectors we can operate in.

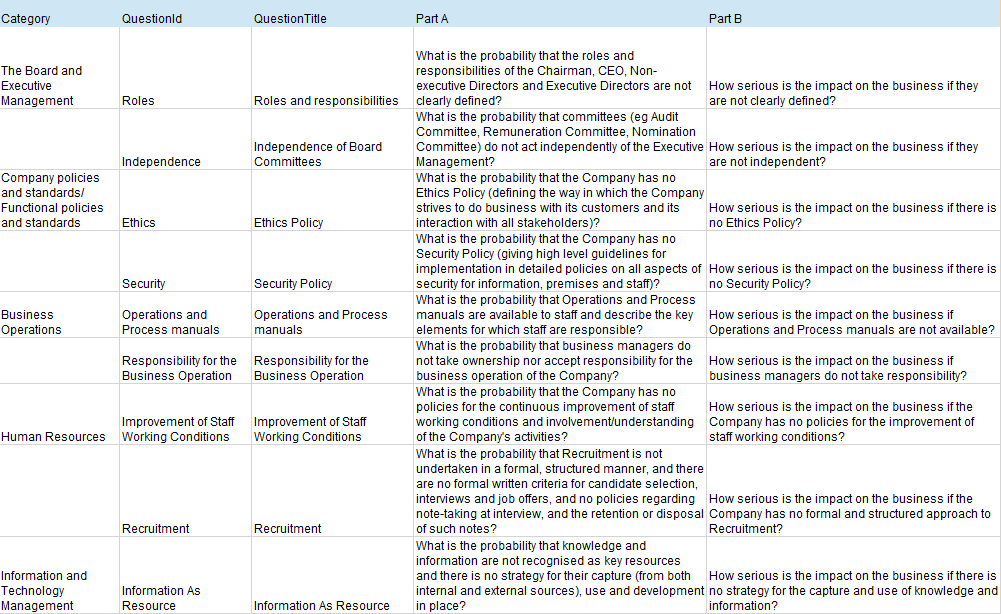

Please study the Key Facts and FAQ`s set out in later sections to understand the detail we go into. We know we ask a lot of questions, but we make this as straightforward as possible because we must have the right information about your risk to arrange cover on a correct and compliant basis.

We are sure about our processes. We have invested heavily on software in collaboration with Microsoft experts to design our own bespoke approach,

We have spent 18 months developing our own software process. It is a full work through system which means that at any moment in time our records are fully up to date. Documentation will be available instantly, as will up to date statistics to help you manage your exposures, including document production, accounting, claims management and compliance functions all of which will assist us in the smooth day to day running of your account.

This approach also enables us to collate data quickly and efficiently to comply with International Financial Reporting Standards (IFRS17). Further details on solvency and how it affects you and us can be found here

Our internal structure is designed to give you access to your account handler. All staff have to go through training courses from e-learning platforms run out of the UK and according to their global qualifications. www.insurancecompliance.co.uk

Many of the world’s largest international companies, brokers, and insurers (including Lloyds of London) do business with us. We are so confident of our approach that we issue a Charter

Please note that as an Insurer we are unable to provide the same advice as an Independent Broker, but rather advice in line with the products we offer and their suitability to your risks.