Overview

Todays Business world is a complex place where only the strong and well organized will survive.

A company must have robust systems of control alongside the procedures which gather the information which confirms that the company meets the international standards of corporate legislation , financial accounting standards and regulatory requirements at all times.

Together these controls are known as Corporate Governance and to meet the levels required Almaseer has installed,

- A robust team of technically competent employees who are constantly monitored and subject to ongoing training. (See Organogram)

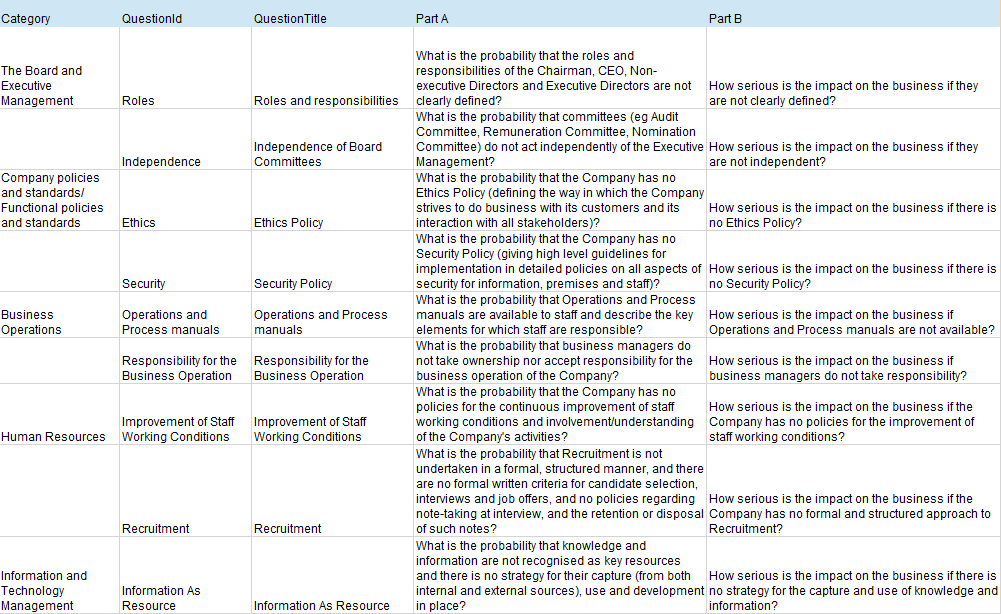

- An independent international team of insurance, risk and compliance experts to audit the company. (See extracts of the annual survey questionnaire)

- We undertake a 3 stage approach to Risk Management, click here ‘Risk Management’ which will take you directly to an explanation of how this operates in practice

- A top 5 global firm of accountants

- Our own bespoke CRM software which allows our risk and finance data to assess company KPI’s and feed IFRS17 Modelling which will enable us to calculate our financial solvency in line with the IFRS17 Solvency regulations. Click here ‘Solvency’ which will take you to the Solvency section.

- Sets of regulations and company practices which set out our moral , ethical, and risk status.(See our Anti Money Laundering Regulations, Bribery Policy and Slavery policy as examples of our depth of approach).

As an Insurance company we strive to be secure for our clients at all times

Governance Structure

We have adopted a “three lines of defence” governance framework. This details responsibility for risk management, risk control and risk assurance; and ensures segregation of duties between those who take on risk, those who control risk and those who provide assurance, the ‘Corporate Risk Management’ tab shows this in more detail. This governance design ensures independent oversight and scrutiny between each line of defence on risk management issues.

The specialist Risk & Compliance Function is positioned in the 2nd line of defence. As well as providing advice and support, the Risk & Compliance Function provides oversight, scrutiny and independent assurance that risk management policies and procedures are operating effectively and efficiently in accordance with the risk appetite set by our Board and meet the requirements of applicable laws, regulations, guidance and best practice statements.

Almaseer Company Policies

Please check the following Company Policies designed and implemented to reflect Almaseer Insurance Company’s’ position on:

These Policies are dynamic by their very nature and can be subject to change with no notice to reflect changes to legislation and our own internal procedures. The Policies above reflect the Almaseer Boards position as at 1st January 2022.