Almaseer understands how to help you to evaluate your risks

Running a business means you accept taking risks and understand the need to make a profit.

This profit must be protected. No enterprise can continue to stay in business if it has to fund claims from cash flow.

To build a sensible insurance and risk control plan you need first to have to identify those risks where:

- you can avoid risk through sensible management

- where a reduction in risk is possible with investment

- you calculate which losses can be retained through self-insurance

- Choosing those exposures you wish to share with others through insurance.

The balance of risk protection between all of these four is what you need to judge. Every business is unique and conditions in Iraq are ‘dynamic’, where many factors can change overnight or in a short space of time affecting a business.

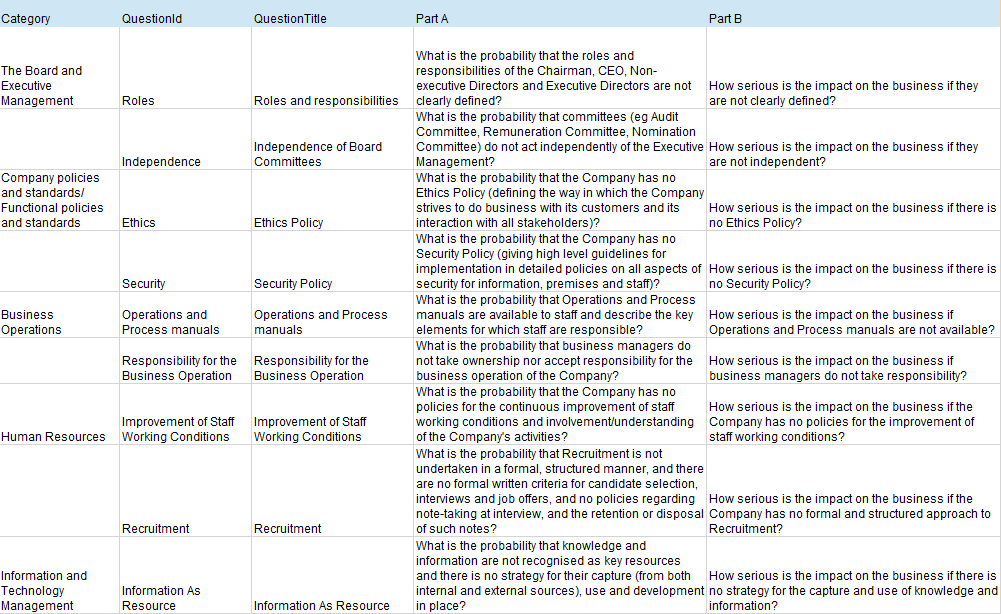

At Almaseer we separate our approach into identifying your risks as

- Financial

- Non-Business

- Business

For example, there are the conventional risks to insure such as liabilities that you have taken contractually which must be insured and Fire losses, which we all understand.

However are you exposed to emerging problems , a real time example being your delivery supply chain. Post-Covid, is it as reliable as before? Can you insure your exposure, or is this one to risk manage.?

There are many more exposures that are unique to you.

Almaseer can help you do these exercises so that your expenditure and risk control are balanced.

Whatever you decide, please do the analysis first. Don’t get caught unprepared